ecolytiq

Project Name

ecolytiq - Sustainability-as-a-Serrvice

Headquarters

Berlin, Germany + New York, US

Industry

Green Fintech

Timeline

Jan - Feb 2024

Prototype: Covers base functionalities of the ecolytiq product suite

1. OVERVIEW

ecolytiq was a German fintech company that provided a "Sustainability-as-a-Service" platform to help banks and other financial institutions show their customers the environmental impact of their purchases. Its technology analyzes transaction data to calculate carbon footprints and offer sustainability-related content and compensation options directly within banking apps. The company is now part of Clarity AI, following an acquisition in July 2025.

During my time at ecolytiq, I was the sole Senior UX Designer. For a whitelabel solution, I was collaborating with multiple teams, both internally and with the bank clients themselves. With the product itself, I contributed to its success and awards.

Key Problem

Traditional financial services lack the tools to provide clear, actionable insights into how spending habits contribute to carbon emissions, making it difficult for consumers to align their financial behaviours with their environmental values. Consumers have been looking for a solution where they could directly see how their spending habits affect the planet via a banking platform.

Whom does it impact

ecolytiq’s product suite impacts sustainability-conscious target groups, which tend to be younger people (22-45 y.o.) or affluent households from highly urbanized global cities. in four major continents: Europe, North America, Asia and the Middle East subregion.

With this target group, ecolytiq offers possible solutions to reduce their footprint with a variety of sub-products like carbon offsetting or green ETFs.

Results:

By using the ecolytiq product suite in 2023:

- 520,000 tons of CO2e avoided based on active users across banks, or equivalent to 260,000 roundtrip flights between Berlin and New York

- Total reduced carbon consumption equivalent to the annual emissions of over 50,000 German citizens

- Overall reach of 33 million consumers spread across ecolytiq’s multiple banking clients

- 30% adoption rate of opting in for carbon insights foroneofour clients

- Decrease in carbon intensity per Euro spent from January-June 2023

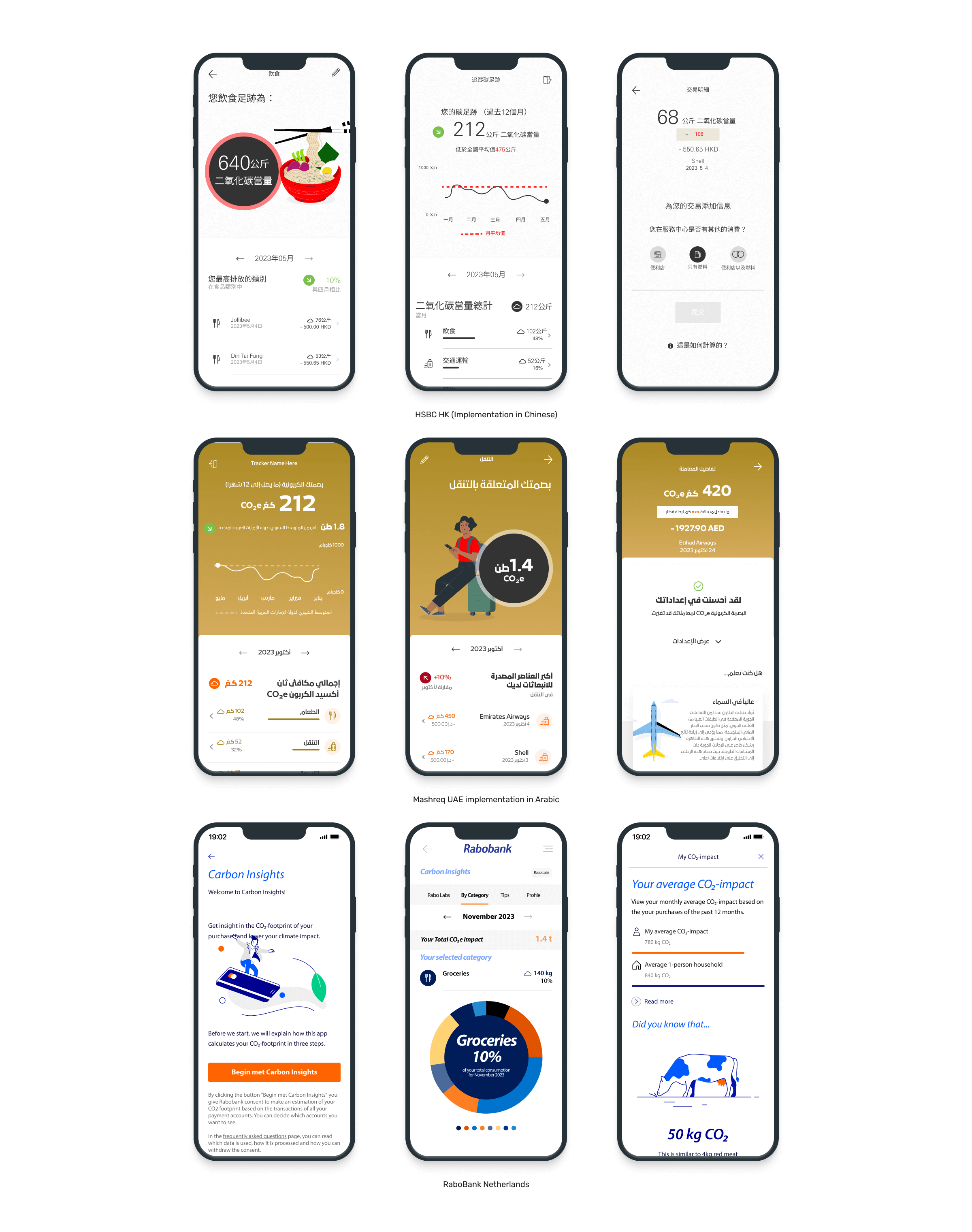

- Two companies who incorporated the ecolytiq suite won Banking Sustainability awards - HSBC UK (Best achievement in Sustainability, Carbon Insights Solution), Mashreq UAE (Sustainable Initiative of the Year, Climb2Change Awards)

- Delivery of whitelabel solution in different cultural, regional contexts (e.g. customized icons and orientations for right-to-left writing patterns like Arabic)

- Over 10 committed clients booked with the ecolytiq solution during my stay (7 whitelabel, 3 sdk)

2. BUSINESS NEEDS & GOALS

Banks face several challenges that ecolytiq's white-label solution addresses:

- Customer Engagement & Loyalty: Digital banking apps often lack features that drive emotional connection and daily engagement. Banks need new, unique value propositions to increase customer Net Promoter Score (NPS), retention, and share of wallet, especially among environmentally-conscious younger demographics.

- Meeting Customer Demand for Sustainability: Over 42% of consumers (number during our research) reportedly want to make more sustainable choices, but they lack the tools to act on this desire. Banks are uniquely positioned to meet this demand and reinforce their brand as responsible leaders.

- Compliance and Green Finance Promotion: There is a growing need to align with sustainability regulations and an opportunity to cross-sell and up-sell "green" financial products (e.g., green loans, sustainable investment funds) to customers whose values align with those products.

Goal / Design Needs

ecolytiq's overarching goal is to embed sustainability intelligence directly into the everyday banking experience to drive measurable behavioral and business impact for the end-user.

ecolytiq directly addresses the target demographic's specific needs by:

1. Offering banks a whitelabel carbon tracking solution

2. Offering customers valuable insights and subproducts to calculate and offset their carbon emissions.

Bank transactions are assigned CO2e values based on regional benchmarks set by our experienced data science team, tailored to each partner bank's location. This boosts the bank’s CSR (Corporate Social Responsibility) and ESG (Environmental, Social and Governance) goals, enhances customer trust through transparency, and integrates green initiatives, offering long-term value by fostering a sustainable connection and awareness.

To give banks empowerment and access to ecolytiq's product suite, enabling them and their target customers innovative carbon tracking and contribution tools that in turn would:

- Enhance sustainability awareness from a purchasing/consumption perspective

- Improve customer relationships & strengthen brand loyalty

- Deliver measurable results to a consumer’s environmental impact

All these factors contribute to increased overall customer satisfaction.

Personal Challenges

Designing for a Million Brands: Balancing Scientific Rigor with Infinite Client Customization

As the sole Senior Designer, my core challenge was ensuring the design system was modular enough to be implemented by dozens of bank brands—each with unique CI, colors, and regional needs—without compromising the scientific integrity and consistent UX of the carbon insights.

Transforming Abstract CO₂ Data into Relatable, Positive Behavioral Nudges.

The key user problem wasn't a lack of desire to be sustainable; it was skepticism and overwhelm when confronted with confusing metric tons of $\text{CO}_2\text{e}$. My challenge was designing a progressive disclosure model that replaced "guilt" with "agency," translating data into simple, locally-relevant comparisons.

Synchronizing complex needs across different stakeholder groups

My personal challenge was serving as the design bridge between four high-priority, often conflicting groups: 1) Data Scientists (focused on scientific accuracy), 2) Product Managers (focused on MVP features), 3) Engineering (focused on API integration complexity), and 4) Bank Clients (focused on immediate brand compliance and custom features).

3. DESIGN PROCESS & CHALLENGE

Design and Prototyping

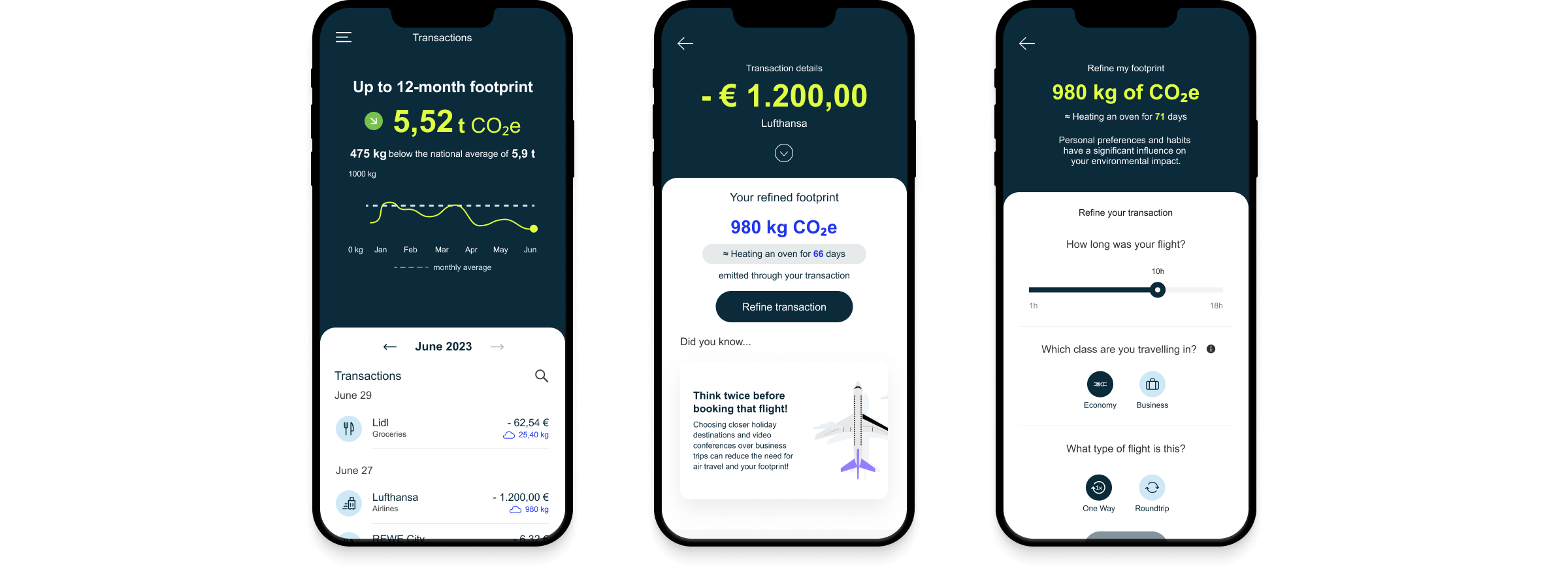

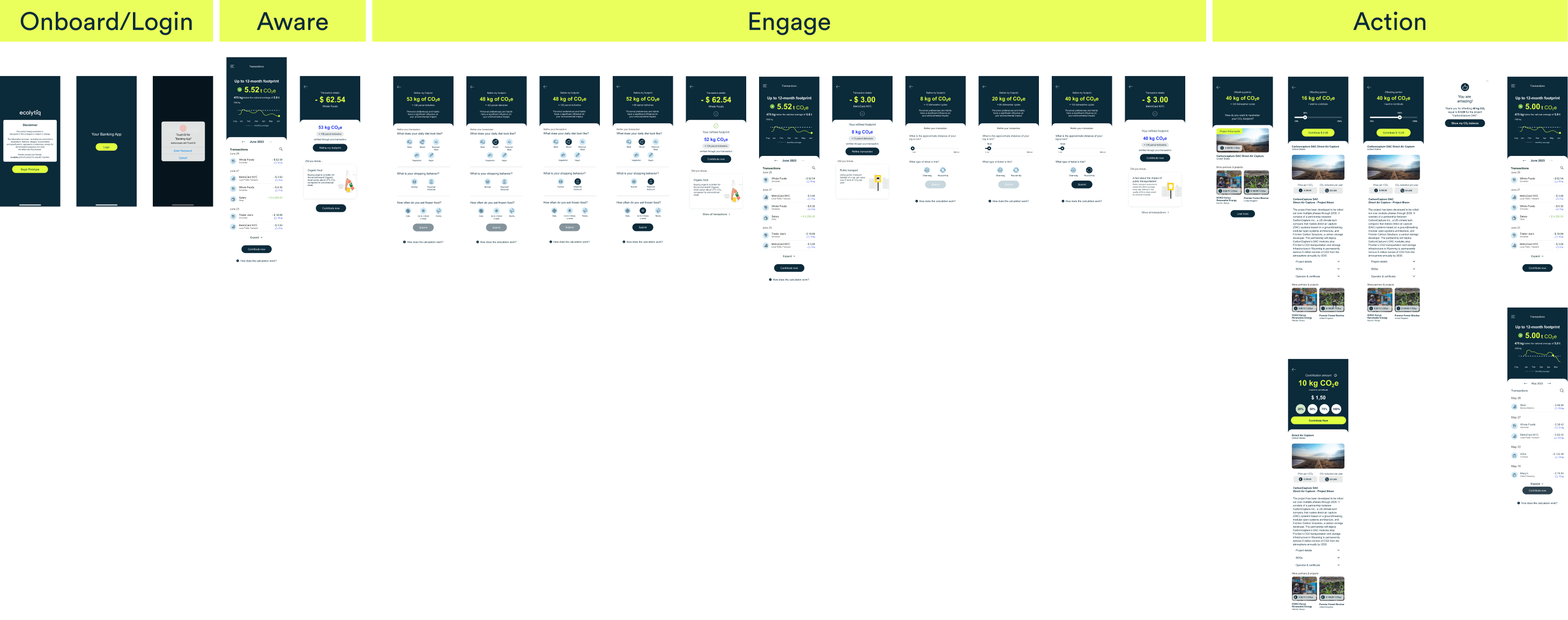

Core Product Flow

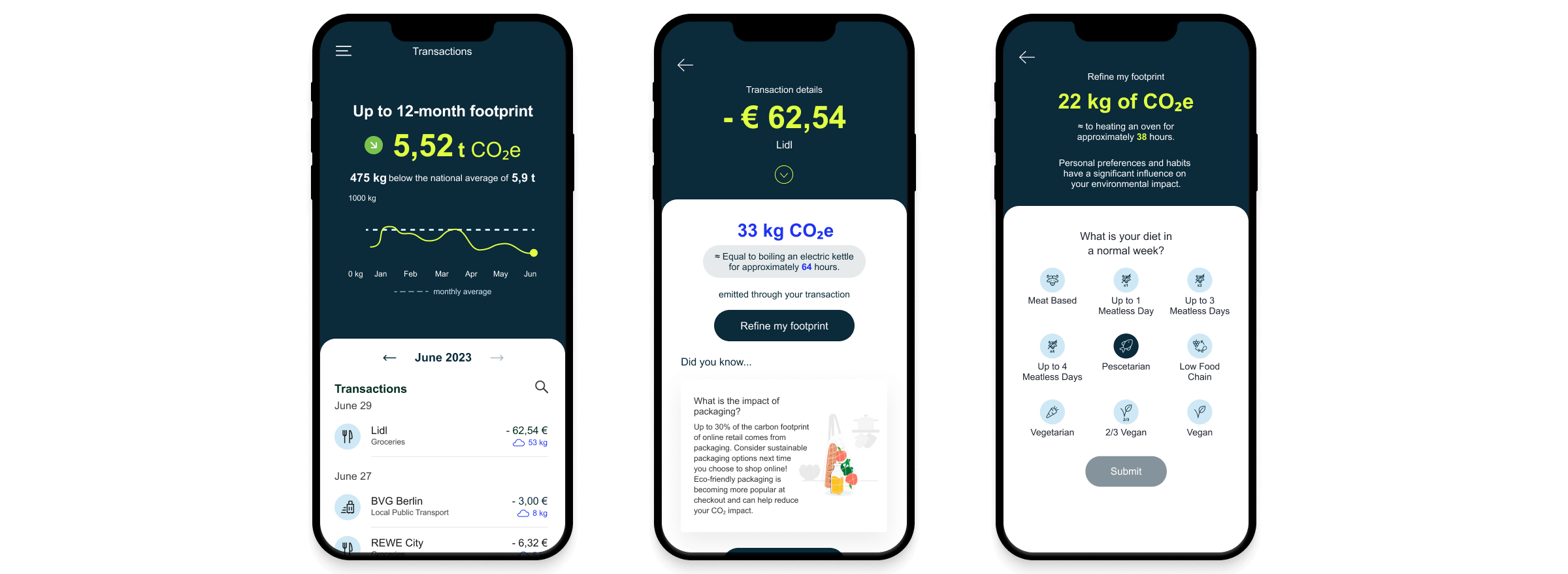

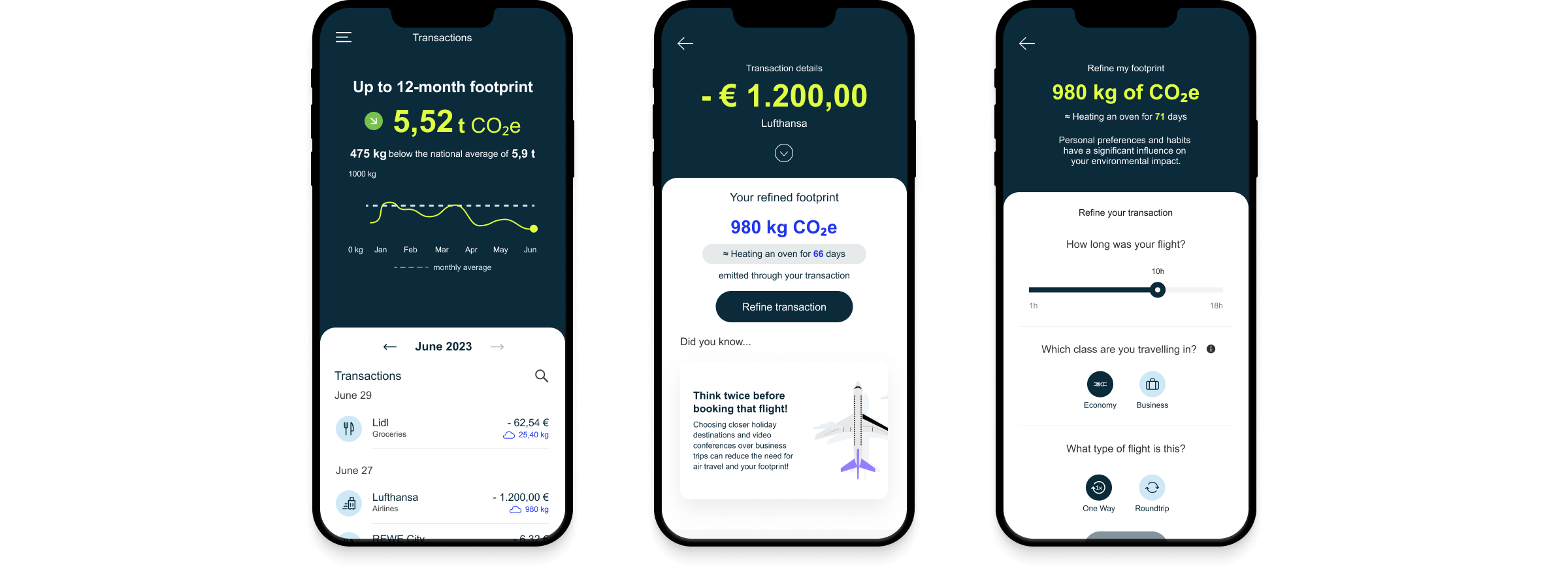

Created high-fidelity mockups aligned with ecolytiq’s brand guidelines for sales pitches and pre-white label implementations, along with clickable prototypes for potential customers to explore the main product suite.

In addition to this, integrated reusable components and patterns into the design system, ensuring consistency across all user touchpoints. Additionally, iterated on designs based on feedback from usability tests conducted by both clients and our product team, making sure that features remain up-to-date and meet specific user needs.

Design System

Whether a bank chooses to customize the design system in-house or decides to go for ecolytiq to deliver a full package, our system is engineered for easy adaptation. This allows banks to seamlessly align the eco product suite with their unique brand identities.

The modular nature of the design system ensures that changes can be made efficiently, enabling quick iterations and smooth implementation, ultimately delivering a tailored and branded experience that meets the specific needs of each financial institution.

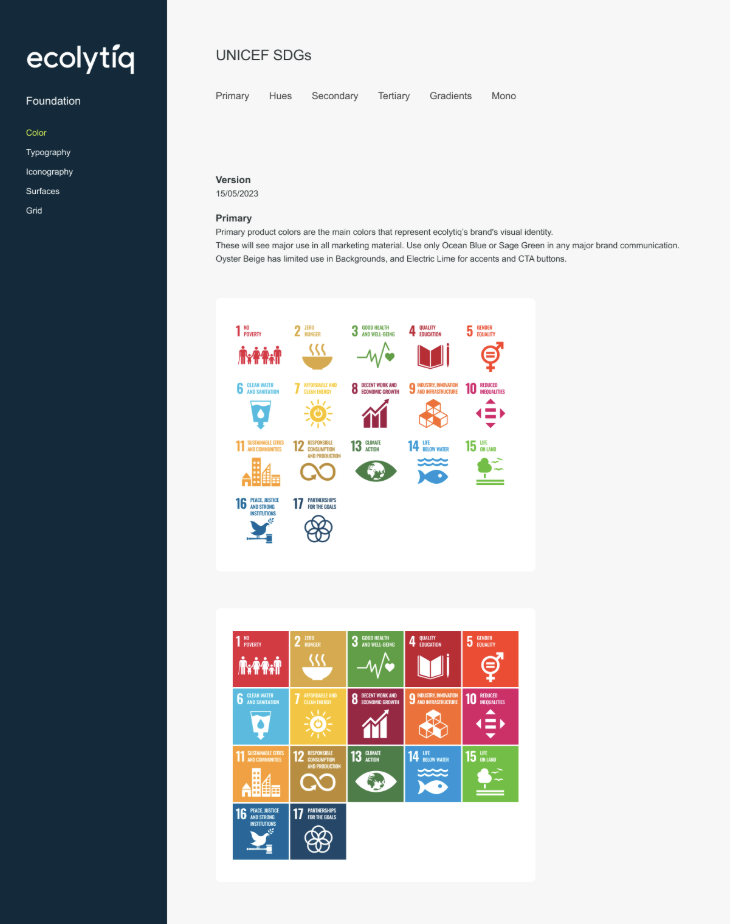

UNICEF's SDG Icons: Unnegotable Design

While the SDGs are a critical part of promoting global sustainability and social responsibility, their strict guidelines and non-customizable nature posed a small bottleneck in the branding process. This limitation required us to carefully balance the integration of these universal goals with each bank's unique brand identity.

Despite this challenge, we were able to successfully incorporate the SDGs into the product without compromising on the overall design and user experience.

4. SOLUTIONS

Core Product

ecolytiq's core product is divided into three subproducts, where clients select either part of it or the complete suite to integrate within their banking platforms.

- ecoAction – support platform for sustainable projects through climate initiatives

With each subproduct, I coordinate with different teams responsible for each product. Usually the initial part of the process is the Data Science team researches for potential integrations with carbon calculations for the banking clients, then the process goes through the rest of the team. My responsibility was visualizing in different variations how the data can be represented, mostly whenever a certain amount has been registered from the bank's API. These then go through iteration processes in our product base or whitelabel skeleton, then offered to clients. From there, customization (if booked) will continue.

Clear representations of carbon footprints

Benefit: Users gain a measurable understanding of their carbon footprint, increasing carbon and eco literacy

Value: Users receive numerical data on the impact footprint of their transactions

Engaging UX Content via Insights

Benefit: Users are primed toward sustainable behavior and have upskilled capacity for sustainable consumption

Value: Users are provided with personalized content and insights on their behavior change. The pool of insights are over 250 and scientifically-backed.

Visual categorizations of user carbon consumption

Benefit: A clear breakdown of carbon consumption helps users identify and act on specific areas to reduce their impact.

Value: A detailed visual breakdown and categorization of carbon consumption offers users a comprehensive view, encouraging effective, well-rounded environmental actions.

Customized Whitelabel Implementations

With ecolytiq's whitelabel solution, our product suite was carefully integrated with the clients' brand C.I. - including customized features which best fitted their specific needs. The usual process for this was we had consultation / presentation sessions where working prototypes were presented to the client. Once a client is booked, we start with either doing user interviews to get a feasibility gauge of their user base, then also discuss with their individual tech, design and management teams.

4. RETROSPECTIVE

Region-Specific Differences

Region-specific product adaptations are essential due to cultural and regulatory differences - Such as tailoring Halal-specific elements for Islamic countries, focusing on consumer add-on subproducts for Asian markets, and ensuring strict compliance with EU/UK/USA regulations. Some examples:

- Islamic Regional Concerns: Iconography, language, and tone need to be tailored to align with cultural expectations, e.g. for Islamic countries. Additionally, using a right-to-left format holds significant cultural importance. Some icons and carbon calculations like using pork or alcohol are replaced with culturally-relevant imagery.

- Shift in Focus for Asian Markets: There is a shift towards focusing on consumer add-on subproducts, specifically designed to cater to the needs of Asian markets

- Compliance Concerns in specific markets: There are ongoing concerns related to compliance with regulations e.g. in Canada with an automatic timeout feature

- Lack of Eco-Education: Based on user interviews and client roundtables, there is a general lack of eco education and confusion around complex scientific terms like carbon emissions and carbon credits. These are specifically more evident in the North American, Asian and Middle Eastern markets.

- Little to No Experience with Carbon Trackers

- There is strong interest with users opting to the ecolytiq suite within their specific banking platforms, however there is little to no experience with how they work.

Learnings

- Different markets have different calculations and client needs - nuances on currencies. This was then manuallly determined by our data science team, which on a usability level provided challenges with representation (e.g. fractional values, too long descriptions)

- User needs and client needs are usually difficult to coincide together e.g. monetization vs. CSR, etc.

- Geopolitical and religious concerns e.g. some insights are not relevant to the specific market, or some iconography/illustrations do not exist in specific regions

- As a whitelabel product, flexibilities within the design system to accommodate more specific customer needs

Company Values

Empowering Customers

ecolytiq simplifies understanding the impact of purchases, offers sustainable guidance, and enables direct climate-positive actions.

Fostering Systemic Change

ecolytiq ensures scientific alignment and engages stakeholders in impactful strategies.

Transparency

ecolytiq openly acknowledges impact measurement challenges, commit to refining methods, and maintain unwavering transparency in our product representations.

Credits

Design Ownership: Aaron Roselo Prototypes, Design System, Whitelabel Implementations, Coordination with PM’s and Development team, User research/client research

Key Collaborators:

Brand & Marketing - Carla da Silva, Melissa Chien, David Lais

Product Managers - Moritz Walther, Henriette Frey, Julia Scholz

CSM - Jörg Müller, Frederick Goold

Data - Gracia Castillo, Andres Perez